Politics and commercial real estate are more intertwined than most people believe. Experienced investors understand the impact of the political climate on commercial real estate, which is why they are actively aware of governmental policies, nominations, etc.

Rather than supporting specific candidates, they look closely at their politics and stances on investment regulations. As industry experts, we know how much a single change in state and federal governments can affect the industry and want to extend this knowledge to you.

This blog post will discuss the primary political aspects affecting commercial real estate and explain how they change trends.

Impact of Political Climate on Commercial Real Estate

Following are the primary ways the political climate affects the commercial real estate industry:

1. Taxation Policies and Demand

Different candidates have different views about commercial real estate taxation, especially from an investment perspective. Some people believe in higher taxes, while others do the opposite based on how they think the industry can best contribute to the economy.

In our experience, most investors prefer to shift some of their portfolios elsewhere if they know a particular state has elected someone who supports the tax increase. They want to maximize their earnings and can often afford to switch things up.

2. Federal Interest Rates

Interest rates and regulations can affect inflation, lending policies, and commercial real estate. Governments often try to curb uncontrolled inflation by increasing federal interest rates, pushing the banks to follow suit.

This increase also curbs commercial real estate transactions as the higher borrowing rate lowers the overall ROI. You may have observed the changes in the industry recently, and several of those resulted from the Federal increasing the base rate to 3.75%-4%.

The move generally curbs industry demand in hopes of easing inflation.

3. Climate Policy

Climate policy has been a critical political aspect for commercial real estate recently. Several political candidates either believe in increasing regulations to make the industry more eco-friendly or leaving it as it is. Some are neutral, and their politics often dictate the outcome of policies.

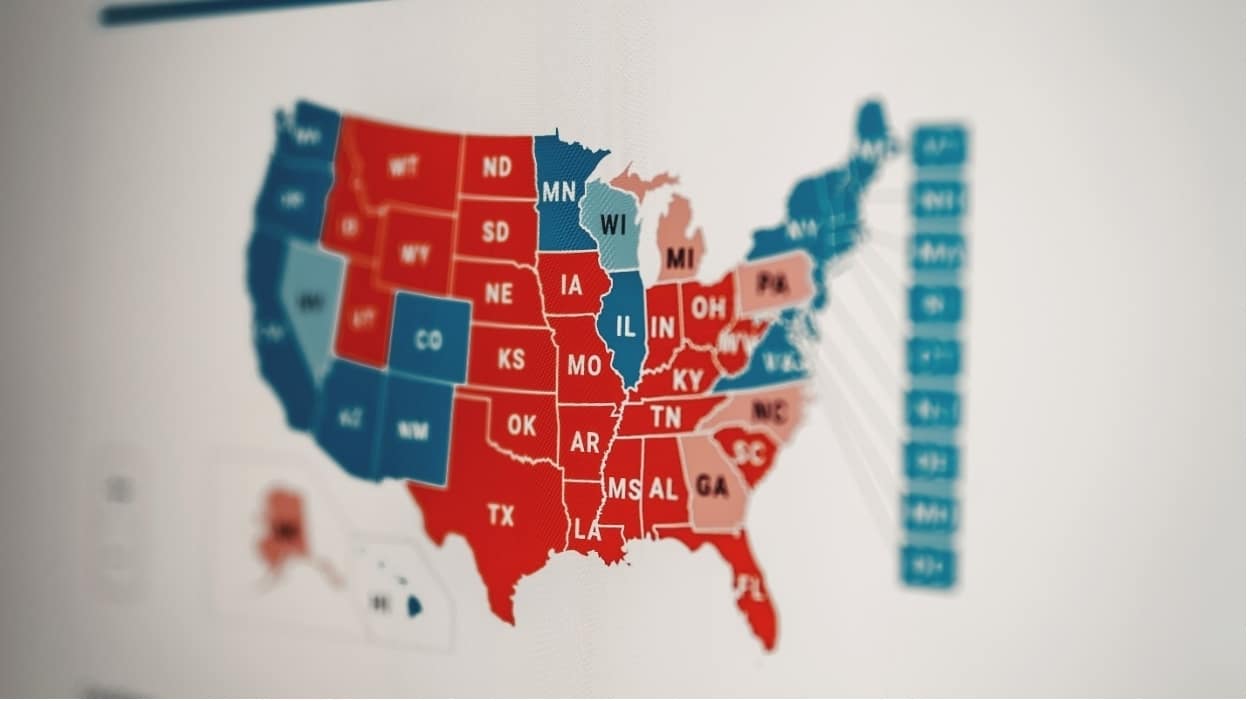

Most blue states are pushing for passing climate-sensitive policies, increasing the overall cost of investment. This move has led investors to increase their focus on red states.

4. Stimulus and Subsidies

The recent pandemic lockdowns devastated everyone, especially the commercial real estate industry. Investors barely made any money on commercial or office buildings and incurred heavy losses.

The industry needed stimulus and subsidies to push through, and the matter became political. The pandemic is one example of how stimulus and grants can be politically motivated, but it is far from the only one. Economic uncertainties, natural disasters, and similar incidents make the matter political.

5. International Relations

Lastly, international politics significantly affects commercial real estate, as seen in the Russia-Ukraine conflict. Wealthy investors buy commercial real estate in other countries, and political unrest and conflict can affect the global market.

Wrapping Up

In short, the political climate’s impact on commercial real estate can affect industry trends, earnings, and growth.

Please contact CHRE to make safe and lucrative investments in commercial real estate in Rio Grande Valley. We know how to navigate the political climate and choose the best options for your portfolio.

Leave A Comment